arkansas estate tax statute

Parents siblings or other relatives inherit half of intestate property. Title 21 - Public Officers and Employees.

Arkansas Inheritance Laws What You Should Know

If any person for the purpose of avoiding listing for the payment of taxes on any property subject to.

. Title 23 - Public Utilities and Regulated Industries. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. AR Taxpayer Access Point ATAP Voter Information.

Title 24 - Retirement And Pensions. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more. Disposition of property to avoid assessment.

AR K-1FE - Arkansas Income Tax. Spouse of less than three years no children. In fact only an estimated two out of every 1000 estates owe.

Title 22 - Public Property. Arkansas military retirement pay is exempt from state taxes. Arkansas Code Search.

Fiduciary and Estate Income Tax Forms 2022. In fact only an estimated two out of every 1000 estates owe federal estate tax. A percentage of the purchase price of the home is used to calculate the tax and whether the buyer or seller pays the tax varies by state.

Arkansas Estate Tax Statute. Arkansas Property Tax Statutes 26-2-107. Want to avoid paying.

Title 25 - State Government. AR1002ES Fiduciary Estimated Tax Vouchers for 2022. Spouse inherits half of intestate property.

In Arkansas transfer tax rates have. Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys. Arkansas military service members veterans and families should file consumer complaints with the Attorney Generals office on ArkansasAGgov or by calling 800 482-8982.

Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes. Likewise 17 states exercise their own estate tax laws so consider this in your estate plan. Most states with an estate tax base their rate on the federal estate tax.

Real Property Transfer Tax applies to transferring ownership of mineral rights. Online payments are available for most counties. Home Excise Tax Miscellaneous Tax Real Estate.

According to Amendment 79 the taxable value cannot exceed.

Free Arkansas General Warranty Deed Form Pdf Word Eforms

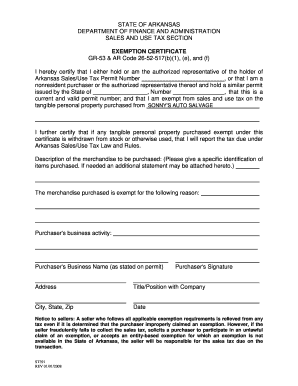

Arkansas Resale Certificate Form Fill Out And Sign Printable Pdf Template Signnow

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

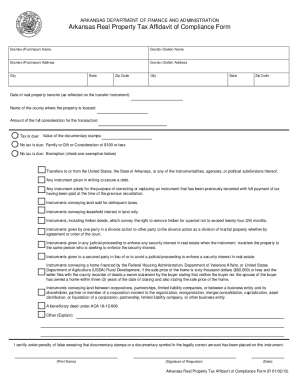

Bill Of Sale Form Arkansas Real Property Tax Affidavit Of Compliance Form Templates Fillable Printable Samples For Pdf Word Pdffiller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Disabled Veterans Property Tax Exemptions By State

Arkansas Code Of 1987 Annotated Court Rules Lexisnexis Store

Arkansas Lawmakers Enact Complicated Middle Class Tax Cut Tax Foundation

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Real Property Tax Affidavit Of Compliance Form Fill Out Sign Online Dochub

Learn More About Arkansas Property Taxes H R Block

Arkansas Commissioner Of State Lands

Arkansas Code Of 1987 Annotated Lexisnexis Store

Little Rock Arkansas Tax Law Lawyers Hyden Miron Foster Pllc

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Free Arkansas Estate Planning Checklist Word Pdf Eforms

Arkansas Small Estate Affidavit Requirements And What To Know Youtube